By Niraj Chokshi July 15

The state pension shortfall is closing in on $1 trillion, according to new Pew Charitable Trusts research.

The gap between the benefits promised and funding available to state retirement systems rose by about 6 percent to $968 billion in 2013, the latest year for which data is available. That number is likely skewed a little high because it’s weighed down by losses from the Great Recession and hasn’t yet factored in some of the gains from the recovery. But even those gains will do little to offset that shortfall:

“State and local policymakers cannot count on investment returns over the long term to close this gap and instead need to put in place funding policies that put them on track to pay down pension debt,” the Pew authors say.

If states are going to close their funding gaps, they’ll have to make adequate annual contributions. But measuring those payments is easier said than done.

One measure of the adequacy of pension contributions is known as the “actuarially required contribution.” Only 24 states set aside at least 95 percent of the ARC goal. It’s a useful yard stick, but one that misses key information about the health of pension payments.

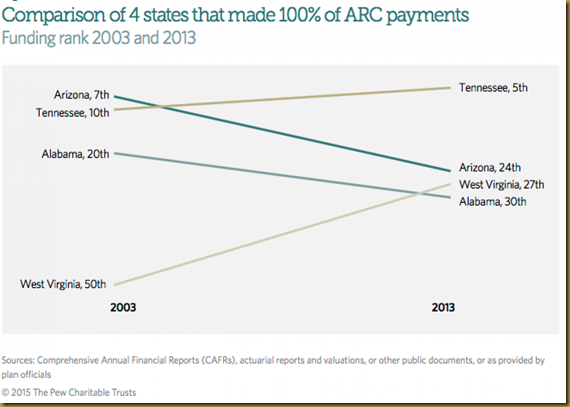

As the chart below shows, states can fully meet their contribution goals, as defined by the ARC, and still end up with dramatically different results in terms of how well-funded their pensions are.

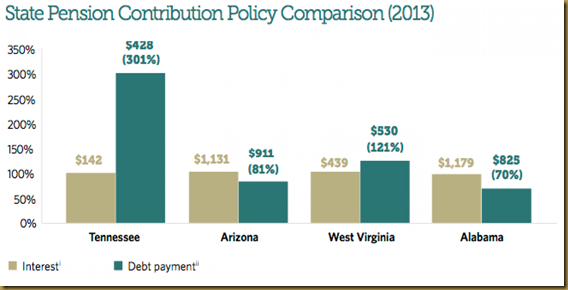

That variation is due in part to how states let debt grow. If the state’s debt payment is smaller than the interest on that debt, the problem just gets worse.

In Tennessee and West Virginia, for example, payments made in 2013 exceeded interest, meaning they were able to chip away at their funding gaps. Arizona and Alabama, however, were not paying enough to even beat back interest, so the gap continues to grow.

But the ARC era may soon be over, Pew notes.

New standards will kick in with the 2014 data, giving policymakers a better assessment of pension contributions and better measuring liabilities, investment returns, new benefits issued, and the market value of pension assets.

Niraj Chokshi reports for GovBeat, The Post's state and local policy blog.

Комментариев нет:

Отправить комментарий